Give

See what God can do through your generosity.

Why Give?

Put God First

Everything we have comes from God. When we give the first 10% back to Him, we’re not just following a biblical principle — we’re honoring God and declaring that He comes first in every part of our lives.

Model Generosity

God showed us what true generosity looks like when He gave His only Son for us. Now, we get to follow His example — giving freely and joyfully, breaking free from the pull of greed, and trusting that God will provide.

Transform Lives

Every gift to the local church becomes part of something eternal. Through your generosity, lives are being changed, hope is being restored, and God’s love is reaching people across our communities and beyond.

Stories of Generosity

We believe generosity inspires generosity. When we give out of gratitude for all God has done, we reflect His heart and become part of His work in the world. These stories remind us that when we open our hands and allow God to work through us, He transforms us and others through His grace.

Where Your Money Goes

When you give to Echo, your gift fuels transformative Kingdom work across four key areas:

Spaces for Worship Experiences

We are creating environments across every Echo campus — North San Jose, Sunnyvale, Fremont, and online — where people encounter Jesus, grow in community, serve with purpose, and live out their faith. Your generosity enhances and expands these spaces, opening new doors so that even more people can hear about the love of Jesus and step into a transformed life.

The Next Gen

We’re investing in young lives — students, young adults, interns, and apprentices — equipping them for faith and leadership. Your giving supports camps, internships, young-adult gatherings, and ministry training, all so the next generation is ready to lead.

Echo Compassion

Your gift reaches beyond our walls, locally and globally. It supports vulnerable children through foster care partnerships, funds church plants across the Bay Area, equips global missions, and partners with ministries tackling poverty, human trafficking, AI-era challenges, and other pressing issues.

Growing Together in Echo Groups

We want every person to grow spiritually and live out their faith in everyday life. Echo Groups are at the heart of that journey — places where people build friendships, study Scripture, pray together, and grow spiritually. Your generosity supports this ecosystem by resourcing camps and retreats, Echo Worship projects, and tools like the Echo app that help groups stay connected. Together, these environments create a rhythm of belonging and spiritual formation throughout the week.

“For this mission will do more than bring food and water to fellow believers in need — it will overflow in a cascade of praises and thanksgivings for our God.”

— 2 Corinthians 9:12 (NLT)

Ways to Give

All gifts are tax-deductible. Our Tax ID: 22-3979908.

Corporate Matching

Many companies offer donation matching programs that can double — or even triple — your gift to Echo.Church.

Check with your HR department or your company’s internal giving portal to see if donation matching is available. If so, select or nominate Echo.Church as your charity of choice.

Echo.Church is also a registered charity with Benevity, a platform that connects companies with nonprofit organizations. If your company uses Benevity, you can find us within their platform.

Here are just a few Bay Area employers who use Benevity.

.png)

Your Giving Records

Check your contribution records, automate your giving, or make changes to your profile.

More About Giving

Find quick answers on a variety of giving topics.

Overflow can process whole shares of publicly-traded stock, including 401(k)s and IRAs. However, because givers often incur penalties for withdrawing these assets before a specific date, we highly recommend consulting your tax professional before giving these types of assets. Giving 401(k)s or IRAs could result in tax penalties or even fewer tax benefits than giving cash.

We send your printed contribution statements by mail every year by January 31. We also send an email with a link to download your contributions statement at my.echo.church.

You can give any publicly-traded stock through Overflow.

Giving Appreciated Stock

Giving stock that you’ve held for over a year can save you up to 37% in federal income taxes based on the value of the charitable gift when itemizing deductions and protect your realized gains from being subjected to long-term capital gains tax, which can be up to 20%.

Consult with a tax professional to understand the full tax benefits of giving appreciated stock, including potential state tax savings.

Giving Company Stock Outside the Trading Window

If you received company-distributed stock as an employee and the trading window is not open, your brokerage will likely reject the transfer request. We suggest you ask your company for the trading windows and give during those time periods, which typically are open quarterly for three to four weeks at a time.

Overflow is a digital solution for giving non-cash assets, enabling you to give in the most tax-efficient way. Through Overflow, you can give:

- Via credit, debit, and ACH

- Stocks

- Cryptocurrency

- Donor advised funds (a specialized financial account used for charitable giving)

You'll also have access to a private donor portal to view giving history, transaction statuses, and the ability to update connected financial accounts.

Overflow’s Information Security Program is SOC 2 Type 2 compliant and follows strict criteria set forth by the SOC 2 Framework, a widely respected information security auditing procedure. Overflow does not have access to nor stores any brokerage account login information. For security and data privacy measures, Overflow uses Yodlee, a third-party provider, to handle the brokerage account login process. Over 600 companies including PayPal, Mint, and Amazon use Yodlee to connect their clients’ accounts.

View Overflow’s frequently asked questions to learn more.

To claim your charitable tax deduction, file Form 8283 for the 1040 tax return. To calculate the amount to deduct from your taxes, the general rule of thumb is to deduct the fair market value, which is the average of the high/low prices of the stock on the day it was received by the nonprofit. This is for assets you’ve held for more than a year. The date the stock was received by the nonprofit can be found in the acknowledgment letter you receive from the nonprofit. Include this letter in your tax return.

Our Tax Identification Number is 22-3979908. Echo.Church is a 501(c)(3) tax-exempt organization.

If you’ve previously logged into your account:

- Go to my.echo.church.

- Enter your username and password.

- Click Log In.

- Under Account Info (top right corner), click Giving History.

If you’ve never logged in before, click Create Account and follow the prompts to set up online access.

You can give through your bank’s online bill payment service. Your bank will send Echo.Church the payment, and we will add it to your giving record as if you had written a check yourself. Just indicate “Echo.Church” as your payee, specify your name as the account, and use the following information for the payee address:

Echo.Church

1172 Murphy Ave. Suite 130

San Jose, CA 95131

Allow 24 to 48 hours for your transaction to post to your giving record after we receive the check.

Giving falls into two categories: charitable cash and asset-based contributions. Charitable cash includes gifts made by cash, check, or debit card. Asset-based contributions are non-cash and include stocks, cryptocurrency, mutual funds, charitable gift annuities (CGAs), real estate, and more. We accept all of these options.

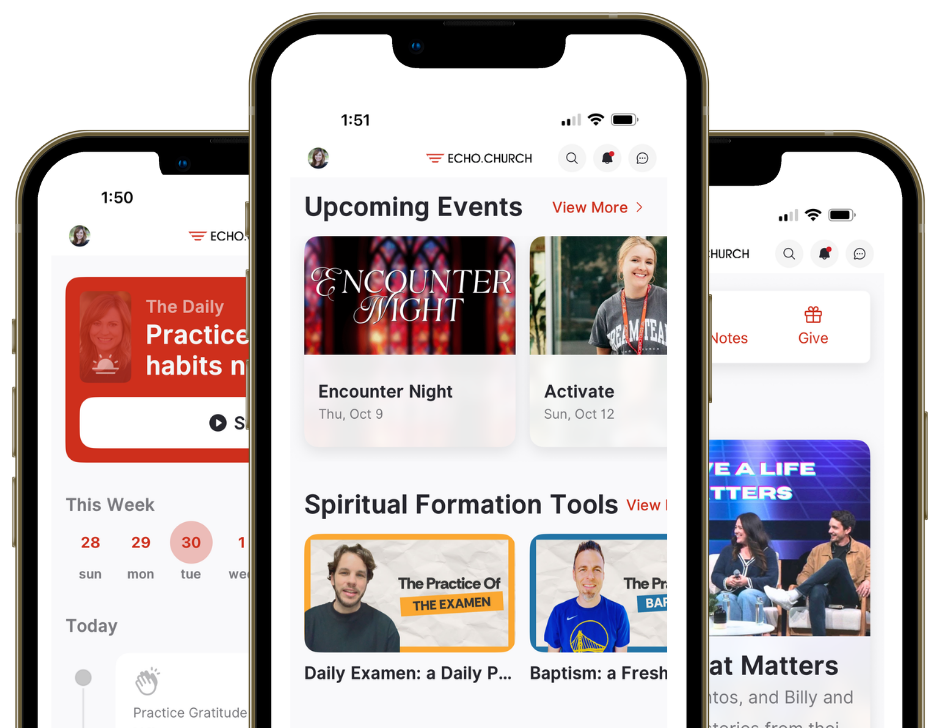

Download the Echo App

Stay connected, watch sermons, find events, take next steps in your faith, and easily engage with our community — anytime, anywhere.